Car lenses can feel quite difficult, but add a Auto Loan Calculator with Negative Equity to the mix and things are becoming even more confused. If you’ve ever wondered: “How much do I really pay if I have my old loan in a new role?” You are not alone. This is where a car sampling calculator with negative equity becomes your best friend.

This tool helps you to see the whole biggest: factors in what you need, how much your car is worth and how the rolling of debts influence your monthly payments. Let’s divide it into a simple and gradual guide.

What is negative equity in a car loan?

Auto Loan Calculator with Negative Equity means you are worth more than the car. For example, if your loan credit is $ 18,000, but the negotiation value of your car is only $ 13,000, you are $ 5,000.

It is like a pizza to pay after having already eaten most and I found that the price is higher than what the pizza is worth.

Why are negative equity is important

If you divide Auto Loan Calculator with Negative Equity into a new loan, your monthly payments can become higher and extend the time required to pay your car. Without a prerequisite, it is easy to underestimate the amount of additional debts that you really wear.

What is a car rendering Auto Loan Calculator with Negative Equity?

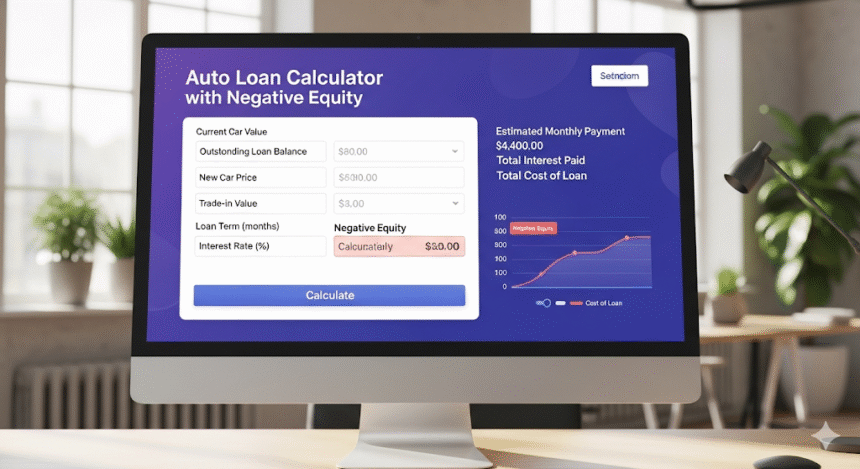

A car rendering calculator with a negative equity is a digital tool that helps you:

Enter your current loan balance

Add the commercial value of your car

Take the price of your new car

See how much negative share transmission

Estimates your new monthly payments

In short, it is like a crystal sphere for your car loan: it shows you the actual costs before engaging.

Step 1: collect correct information

Before using the calculator: Auto Loan Calculator with Negative Equity

Current amount of the loan payment

Trade -in the value of your current car (check Kelley Blue Book, Edmunds or the retailer quotes)

Price of the new car you want

Interest rate offered by the lender

Loan period (number of months)

The more accurate your numbers, the clearer the results are.

Step 2: Insert the balance of the current loan

Enter the amount you still have to on your current car loan. This number is crucial: it is the starting point that determines if you are a negative equity.

Step 3: Add the commercial value

Then enter the estimated trading value of your car. If it is lower than the amount of your loan, the difference is your Auto Loan Calculator with Negative Equity. For example:

Loan balance: US $ 18,000

Commercial value: $ 13,000

Negative equity: $ 5,000

Step 4: Add the price of your new car

Now enter the costs of the car you want to buy. Do not forget to include taxes, recording and costs if your calculator allows. These additional modules can make a big difference in the total loan amount.

Step 5: Add a negative net value to the new loan

Here, the calculator does the heavy work. Your negative equity rolls in the costs of your new car. This deficit of $ 5,000? In addition to your new loan, it is added, which increases the total amount.

Step 6: Define the loan time and the interest rate

Enter the loan period (like 60 or 72 months) and the interest rate. The calculator will now break all the figures and show the estimated monthly payment.

Step 7: View results

As soon as “I kicked” you will see:

Total loan amount (new car + negative capital price)

Estimation of the monthly payment

Total interest rate during the life of the loan

How long does it take to pay your new car

This is “aha!” moment when you see if the agreement is financially useful.

Why use this calculator before buying?

Avoid surprises: nobody likes hidden debts that the flat ones in their new loan.

Piano Vooruit: you can test several scenarios – vs. Longer loan conditions, higher than the drop in interest rates.

Make smarter decisions: this shows that waiting, refinancing or payment can save money in an additional advance.

Tips to minimize the effects of negative equity

The use of the Auto Loan Calculator with Negative Equity is only the first step. To avoid digging a deeper hole:

Take additional payments for your current loan before negotiating. Take into consideration private sale for a higher price than commercial offers from the dealer.

Choose a new less expensive car to compensate the rolled debt.

Save for a greater deposit to reduce the new loan balance.

The role of refinancing

If you are in no hurry to buy, your current loan can reduce the interest rate and help you pay the balance faster. In this way your share situation can be made for a new car when you are ready. How 2025 buyers can use these tools intelligently

Prices and interest rates in 2025 continue to fluctuate and make negative equity for many buyers a real challenge. The good news? Online article calculators are still advanced, with characteristics that even take into account the damping and comparisons of loans side by side.

Read More: Negative Equity Auto Loan: What It Means & How to Escape It

Conclusion

A car Auto Loan Calculator with Negative Equity is not only an unusual tool – it is a financial compass. It helps you understand the real costs for the introduction of old debts into a new car loan and if the company is worth it. By taking a few minutes to connect your numbers, you can avoid financial falls and make decisions that keep your long -term wallet.