If you stick to money and find quick funding, the number of Auto Equity Loan vs Title Loan credit options may seem overwhelming. Among them often appear as rapid solutions. You can be alike – then both use your car to secure money. But here is the capture: they are not identical.

How do you know which one is right for you? Auto Equity Loan vs Title Loan in simple and talkative conditions and compare these two types of loans side by side.

What is an automobile action loan?

With a Auto Equity Loan vs Title Loan of cars, you can borrow money against equity in your car. Equity is only an unusual word for the difference between the value of your car and what you still need.

Example:

The market value of your car: US $ 15,000

Loan balance: US $ 5,000

Your equity: US $ 10,000

With a lender, you can borrow part of this US $ 10,000, usually in the form of a flat amount, while you continue your vehicle as usual. Think like unlocking money hidden in your way.

What is a title?

A titello is a little different. Instead of using the actions, borrow money by transferring the title of your car as a guarantee. In most cases, the vehicle must be paid in full to be suitable. Here’s how it works: give the title of the lender the title of your car and give you a short -term mastery to a high interest rate. If you can’t refund him, the lender has the right to resume the car.

It’s like having your car’s pait: get money, but your property rights are temporarily in danger.

Important agreements between automatic and Titel leningen loans

Before immersing us in the differences, let’s see what they have in common: Auto Equity Loan vs Title Loan

Both are safe loans, which means that your car acts as a guarantee.

The approval is generally faster than traditional bank loans. They can be easier to obtain if your credit is not perfect.

Continue to check your car as you regret the loan (unless you default).

Now that we have shown that, we let the important differences examine.

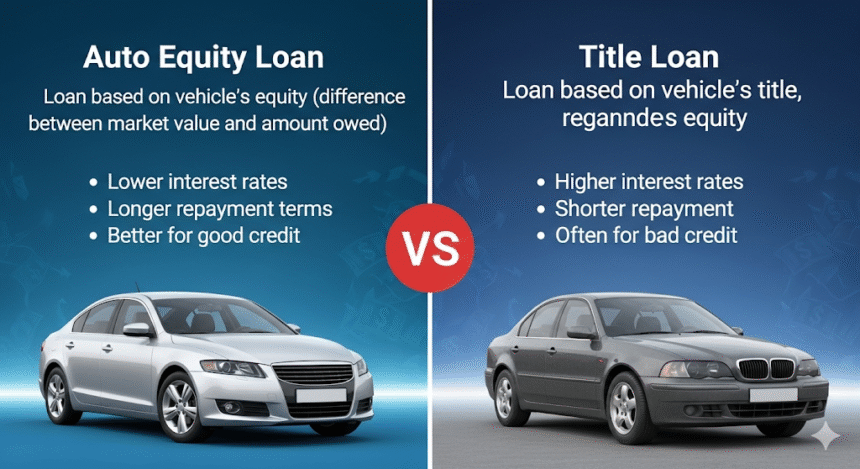

Automatic share loan against title: fundamental differences

Here comes the real comparison.

Property requirements

Auto loan loan: even if you still make payments on your car. Title: Usually it requires having the car completely.

Auto Equity Loan vs Title Loan

Car stock loan: based on the capital you have in the car, often 25-80% of its value.

Title: Usually minor quantities, often only one fraction of the entire value of your car.

Reimbursement conditions

Automatic stock loan: offers longer refund periods, sometimes a few months or years.

Title: in the short term, often due within 30 days. Interest rate

Automatic loan: interest varies, but are often lower than title loans, because the reimbursement conditions are longer.

Title loan: known for high sky interest rates, sometimes more than 200 to 300% April.

Risk of withdrawal

Automatic balance of balance: however, the risk is lower if you adhere to the reimbursement plans.

Title loan: much higher risk – Cite payment and your car could disappear.

What gives you more money? If you want to borrow a greater amount, car sharing loans usually win. Since they are based on your net assets instead only on your title, the cash lenders have previously approved higher amounts.

Titel lenenen, on the other hand, is generally smaller, intended for fast and short -term contact needs.

What costs more long -term?

No sugar coating here – the -Auto Equity Loan vs Title Loan title is often much more expensive. With the triple figures apr, loan costs can quickly escape hands.

The car sharing loans, although not always cheap, generally have lower interest rates and longer reimbursement conditions, making management easier over time.

When does it have a loan with a car does it make sense?

You can consider a loan from car Equity if:

You have a positive equity in your car.

You need an amount of the major loan. You want more time to reimburse it.

You are looking for a safer and more structured reimbursement plan.

It adapts well if you intend to use money for greater expenses such as debt consolidation, medical accounts or home repairs.

When does a titellenining make sense?

Titelleningen may seem tempting as:

You immediately need cash. You own your car.

You are convinced that you can reimburse the loan in a short time.

But here is the reality: due to their imposing interest and short terms, the titles can be risky. They seem more like a final resort option than a reference solution.

Pross and disadvantages of actions for car shares

Advantages:

Larger loan amounts

Longer refund periods

Lower interest rates than the loans of securities

Helps to create credit if he is responsible

Disadvantages:

Risk of losing the car if you are standard

Costs can be applied (evaluation, origin, etc.)

Pros and cons of Titelleningen

Advantages:

Supervelous approval

Minimum credit requirements

Short -term solution for emergency situations

Disadvantages:

Extremely high interest rates

Very short refund periods

High risk of recovery

What is safer: car stock or title loan?

If safety is your most important care, Auto Equity Loan vs Title Loan are usually the most intelligent choice. They give you more space of breathing, manageable interest rates and reimbursement flexibility.

Titelleningen, although fast, can put you in a financial choker if you cannot refund quickly.

Tips before choosing between the two

Evaluate your reimbursement capacity: can you reimburse it realistically in time?

Compare money lamps: rates and conditions vary considerably. Read the small print: seek hidden costs or punishments.

Borrow only what you need: do not complete the loan to the maximum, just because you can.

Take the alternatives into consideration: personal loans, credit associations or loans of loans can be less risky.

Read More: Top Benefits of Auto Equity Loans You Should Know

Conclusion

At first glance, the loans for sharing cars and the loans to the title seem two sides of the same coin. But once dug more deeply, the differences are difficult to ignore. Auto sharing loans generally offer more money, longer conditions and lower interest rates, making them a more confident bet for most borrowers. Auto Equity Loan vs Title Loan , although fast, has higher costs and risks that you can leave without your car.

The bottom line? If you have equity in your car and you need a more manageable loan option, a loan for car actions is usually the best choice. But whatever path you choose, be sure to understand the conditions, weigh the risks and the loan responsible in a responsible way.